Top 10 Reasons USDA Loans in North Carolina Are a Great Opportunity for First-Time Home Buyers

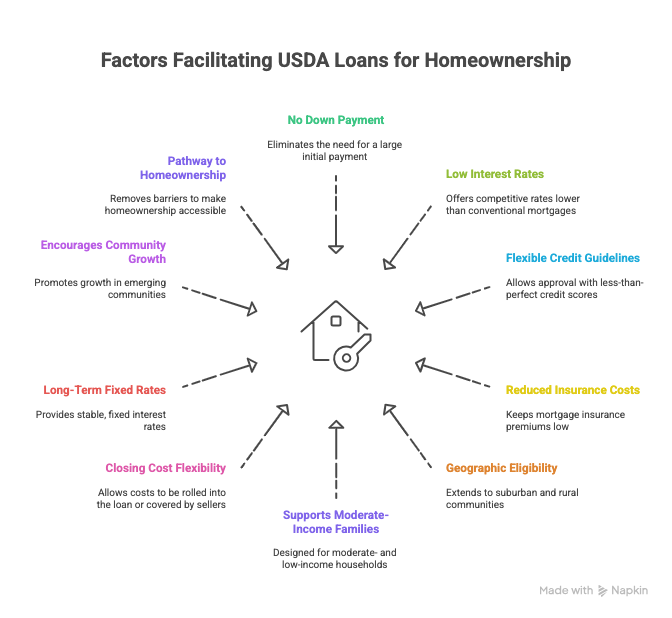

Buying your first home can feel overwhelming—especially when saving for a down payment. For many North Carolina residents, a USDA loan offers a path to homeownership that is more affordable, flexible, and accessible than other programs. Here are the top 10 reasons USDA loans stand out:

1. No Down Payment Required

One of the biggest hurdles for first-time buyers is saving for a large down payment. With USDA loans, eligible buyers in North Carolina can finance 100% of the home’s purchase price, eliminating this obstacle.

2. Low Fixed Interest Rates

Because USDA loans are backed by the U.S. Department of Agriculture, lenders can offer highly competitive interest rates—often lower than conventional mortgages—helping buyers save money month after month.

3. Flexible Credit Guidelines

Many first-time buyers worry that their credit history will disqualify them. USDA loans have more forgiving credit requirements, with opportunities for approval even if your credit score is not perfect.

4. Reduced Mortgage Insurance Costs

Unlike FHA loans, which charge hefty mortgage insurance premiums, USDA loans keep insurance costs low. This means lower monthly payments and more room in the budget for other expenses.

5. Broad Geographic Eligibility

USDA loans aren’t just for farmland. In North Carolina, many suburban and rural communities—even those just outside of major metro areas like Raleigh, Charlotte, or Wilmington—qualify. This opens the door to affordable homeownership near urban job centers.

6. Supports Moderate-Income Families

The program is designed to help moderate- and low-income households. Income limits are generous in most NC counties, making it possible for a wide range of buyers to qualify.

7. Closing Cost Flexibility

Closing costs can be rolled into the loan or covered by seller contributions. This reduces the cash needed at the closing table and makes USDA loans more accessible for buyers with limited savings.

8. Long-Term Fixed Rates

All USDA loans are fixed-rate loans, so buyers don’t have to worry about adjustable-rate mortgages that can spike monthly payments over time. This stability makes it easier to budget and plan for the future.

9. Encourages Growth in Emerging Communities

Many eligible North Carolina areas are growing suburbs and small towns just outside larger cities. Buying in these areas often means lower home prices today with strong potential for future appreciation.

10. Pathway to First-Time Homeownership

For first-time buyers, the USDA loan program removes many of the barriers—no down payment, competitive rates, and flexible qualification standards—making the dream of homeownership a reality sooner rather than later.

Final Thoughts

USDA loans are one of the best-kept secrets in mortgage lending. For first-time buyers in North Carolina, they provide an unmatched combination of affordability, accessibility, and long-term stability. Whether you’re looking in the rolling hills near Raleigh, the mountain towns around Asheville, or the coastal communities of Brunswick County, a USDA loan could be your ticket home.

Disclaimer: USDA loan eligibility varies by location, income, and household size. For the most accurate information, consult the official USDA eligibility map and a licensed North Carolina mortgage professional.

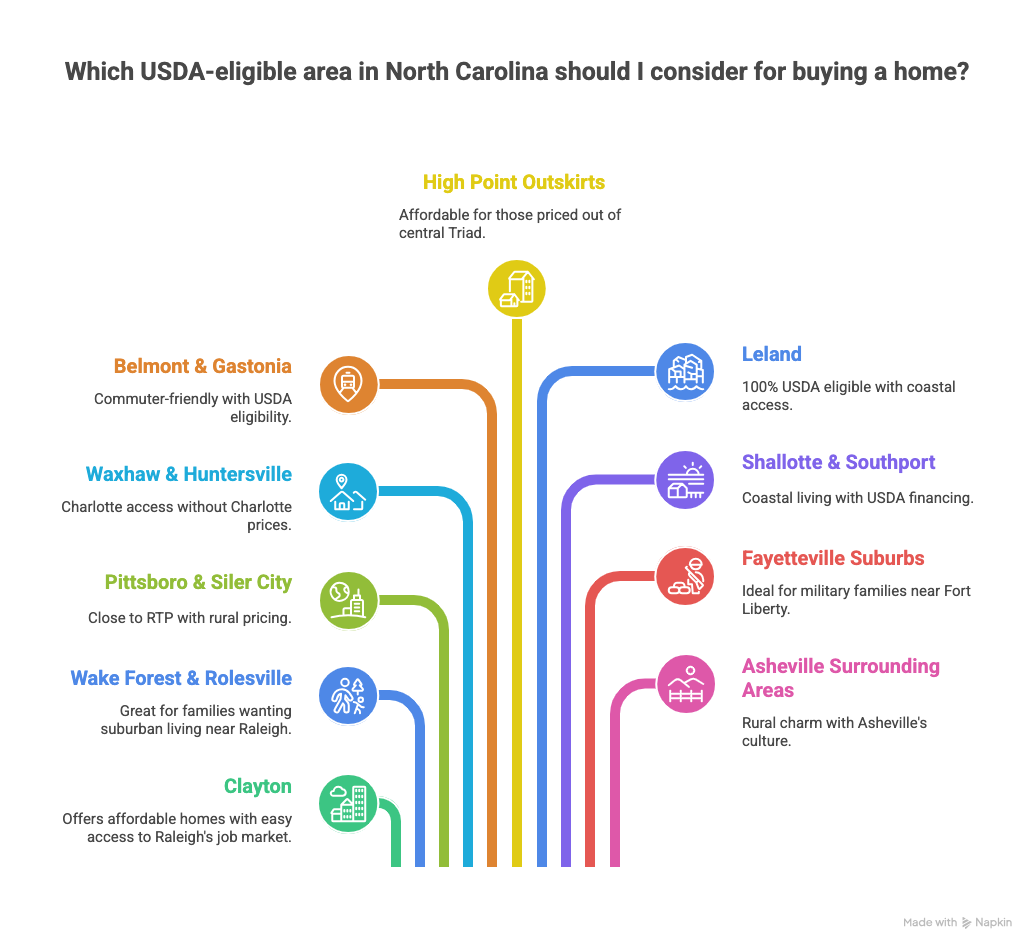

Top 10 USDA Loan Locations in North Carolina Near Urban Areas

1. Clayton (Johnston County – near Raleigh)

-

Just southeast of Raleigh.

-

A growing suburb with USDA-eligible zones.

-

Offers affordable homes with easy access to the Triangle job market.

2. Wake Forest & Rolesville (Wake County – near Raleigh)

-

Northern Wake County remains ~44.8% USDA eligible.

-

Great for families wanting suburban living but proximity to downtown Raleigh.

3. Pittsboro & Siler City (Chatham County – near Chapel Hill & Durham)

-

Fully or largely eligible county.

-

Close to Research Triangle Park (RTP) but more rural pricing.

4. Waxhaw & Huntersville (Mecklenburg County – near Charlotte)

-

USDA-eligible suburbs around Charlotte.

-

Popular for first-time buyers who want Charlotte access without Charlotte prices.

5. Belmont & Gastonia (Gaston County – near Charlotte)

-

Just west of Charlotte.

-

Retains USDA eligibility in surrounding areas, great for commuters.

6. High Point Outskirts (Guilford County – near Greensboro)

-

While Greensboro’s core is ineligible, USDA loans apply in surrounding Guilford County.

-

Attractive for first-time buyers priced out of central Triad housing.

7. Leland (Brunswick County – near Wilmington)

-

Brunswick County is 100% eligible.

-

Just minutes across the river from Wilmington, combining affordability with coastal access.

8. Shallotte & Southport (Brunswick County – near Wilmington)

-

Coastal living with USDA financing still available.

-

Excellent for retirees and first-time buyers alike.

9. Fayetteville Suburbs (Cumberland County)

-

Central Fayetteville is ineligible, but nearby communities qualify.

-

Great for military families from Fort Liberty (formerly Fort Bragg) looking to settle nearby.

10. Asheville Surrounding Areas (Buncombe County)

-

Asheville’s urban core is ineligible, but mountain and suburban areas remain open.

-

Ideal for buyers who want a mix of rural charm and proximity to Asheville’s culture.

Why These Locations Stand Out

-

They strike the perfect balance: affordable USDA-eligible housing and proximity to North Carolina’s largest job markets.

-

These areas give buyers the chance to own a home sooner while staying within commuting distance of major cities.